iKinetiq is Your Community Bank Partner

Community Banks are at higher risk for regulatory enforcement actions and fines, but they usually have smaller compliance budgets and fewer internal resources than their larger bank competitors. Our team is here to help Community Banks tackle their compliance challenges.

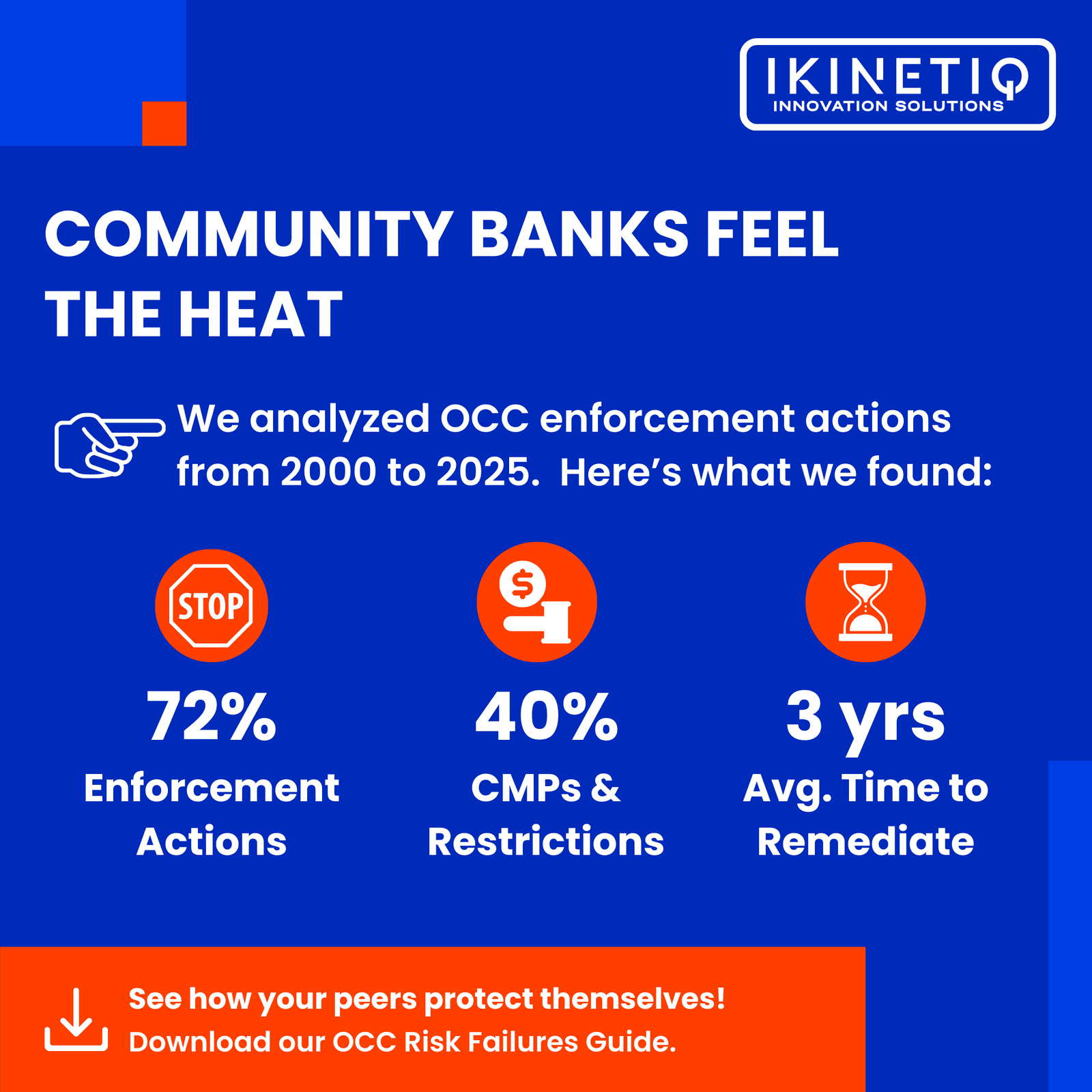

Enforcement Risk Is Rising - Is Your Bank Ready?

See which risks result in in regulator-imposed restrictions, and what you can do to stay ahead of examiners.

Trusted by Community Bank executives nationwide

Which risks matter most in 2025?

Regulators aren't waiting. In 2024, Community Banks made up the majority of enforcement actions from the OCC, FDIC, and FRB.

Our Risk Guide shows exactly where examiners are cracking down — and what to fix before your next exam.

Community Banks Have Greater Risk of Enforcement Actions & Fines

iKinetiq Helps Community Banks Tackle Compliance

Still relying on outdated compliance methods?

Talk to an expert to identify your biggest risk — and fix it before your next exam.