Enforcement Risk Is Rising – Is Your Bank Ready?

Large Community Banks are facing the sharpest rise in enforcement pressure —

with more exam scrutiny, more restrictions, and more risk of penalties.

What the Enforcement Data Shows

25%

Issued Civil Monetary Penalties / Fines

37%

Hit with Growth or Service Restrictions

3 years

Average Time to Close Action

Enforcement Risks Are Rising!

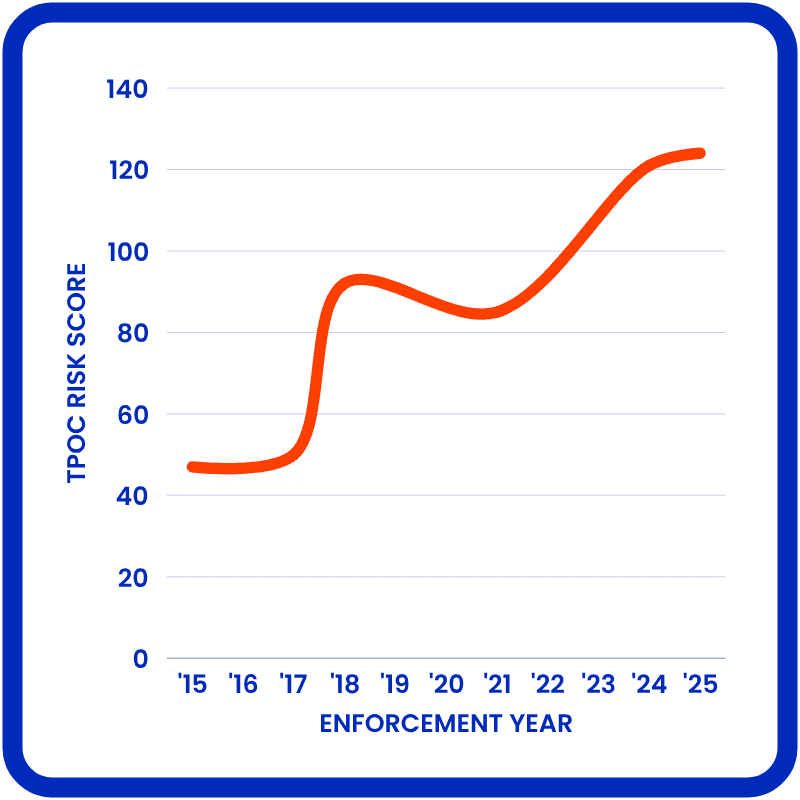

Our 10-year review of Large Community Bank enforcement actions shows a 164% increase in TPOC Risk Scores, our proprietary scoring framework that measures how deeply a bank's risk posture deviates from examiner expectations.

This sharp rise reflects increased scrutiny on compliance governance, third-party oversight, operational controls, and BSA/AML obligations.

We built this framework to show exactly where examiners are cracking down, and how banks can get ahead of these risks before their next exam.

Where Your Bank Stands – and Why It Matters

Ready to See Your Score?

You've seen the data. Now let's score your bank.