Source: American Banker, July 2025, using Capital Performance Group data

Introduction

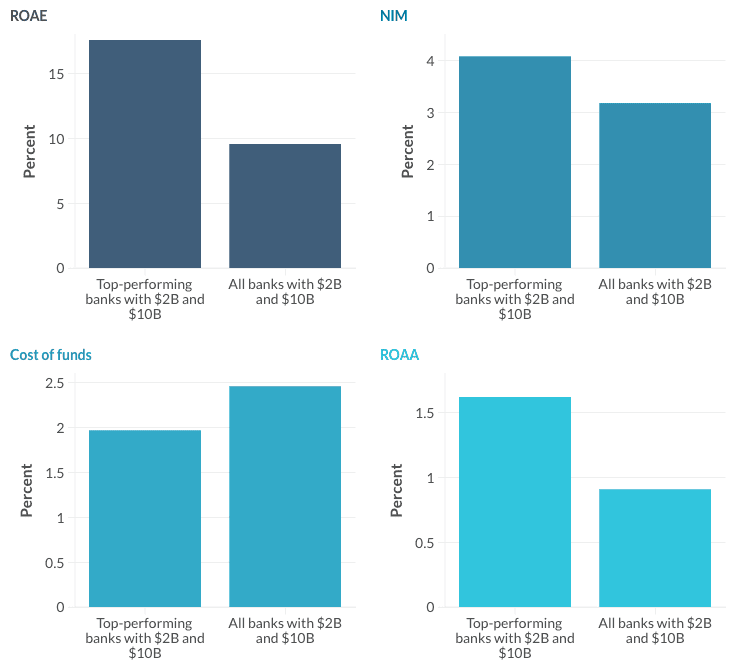

American Banker just released its annual ranking of the 20 top-performing banks with $2B–$10B in assets. These institutions stood out not because of massive growth or fintech flash, but because of something more fundamental, risk discipline.

While 2024 squeezed margins across the sector, these banks managed:

- Lower cost of funds (1.97% vs. 2.46% peers)

- Higher Net Interest Margins (NIMs) (4.08% vs. 3.18%)

- Stronger Return on Average Equity (ROAE) and lower efficiency ratios

Why It Matters

In a year of much greater regulatory enforcement actions, these banks still pulled ahead by doing the basics exceptionally well, controlling funding costs, maintaining credit quality, and investing in deposit relationships. That makes their 2024 performance really stand out.

Now, in 2025, regulatory enforcement actions have virtually gone quiet. But that’s exactly why this matters.

The vast majority of these top-performing banks have no enforcement history over the last 25 years. That’s not luck. It’s disciplined risk management, and it shows up in their performance. Even among the few FDIC-regulated banks with past enforcement issues, the record shows correction and recovery rather than repeat violations.

What this proves is simple. Banks that consistently manage risk well outperform their peers even amidst heightened regulatory enforcement. These institutions stay exam-ready, strategically focused, and financially strong through every cycle. “Discipline first” isn’t just a compliance mindset. It’s a performance advantage.

Where iKinetiq Can Help

We help forward-looking banks, especially Community Banks with total assets $1B to $10B:

- Benchmark against risk and regulatory trends (including top-performer profiles)

- Identify blind spots before examiners do

- Prepare for the coming shift in enforcement posture expected for the remainder of 2025 and into 2026

👉 Want to see how your bank stacks up? Book your free 30-minute consult.

© 2025 iKinetiq Innovation Solutions, LLC. All Rights Reserved.