Prepare for 2026 supervision expectations with clarity and confidence

Community Bank supervision is shifting toward examiner judgment, evidence, and impact. Banks are increasingly expected to explain how they understand, govern, and manage risk, not simply demonstrate that policies or checklists exist.

The 2026 Community Bank Supervision Blueprint distills key supervisory signals from the OCC, FDIC, and Federal Reserve into five practical predictions and a clear, exam-ready framework. It is designed to help boards, senior leadership, and exam teams align priorities, strengthen oversight, and prepare clear narratives supported by evidence.

This Blueprint is most effective when used as a shared reference across governance, risk, compliance, and third-party oversight functions.

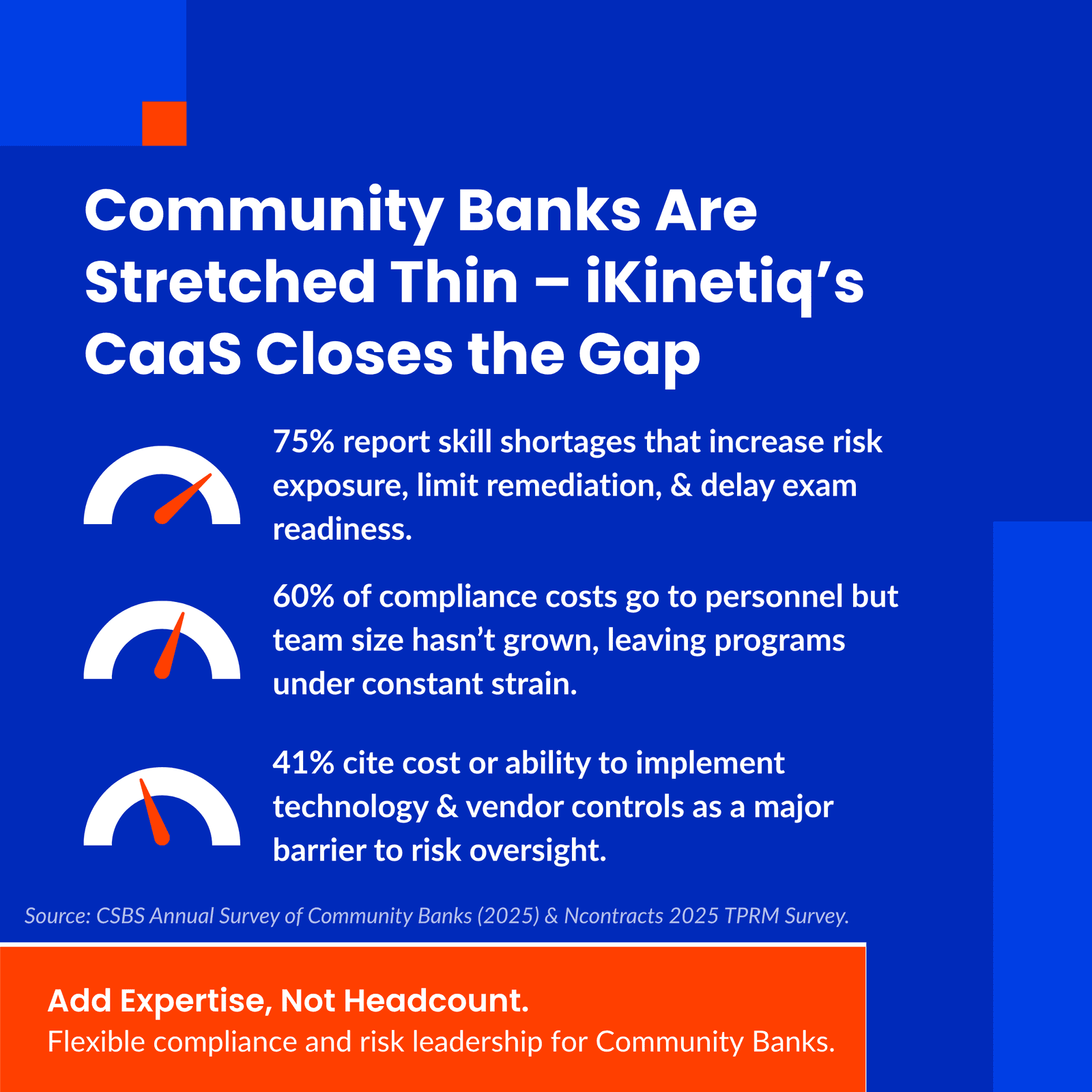

Consulting-as-a-Service for Community Banks

Community Banks are navigating limited resources, regulatory uncertainty, and rising vendor-resilience expectations, all with teams that are already stretched thin.

CaaS from iKinetiq connects your bank to regulatory, compliance, risk, and third-party experts — available immediately, without the staffing delays or budget strain of hiring full-time staff.

Welcome

I founded iKinetiq because I saw a need to do business differently — to challenge the status quo, embrace innovation, and use technology responsibly.

We’ve now launched a new era, working closely with our technology partners to build a next-generation client experience tailored to the needs of financial institutions — especially our Community Bank clients. These tools and resources are at the heart of the services we deliver in 2025.

I invite you to join us on this journey. We look forward to partnering with you.

Not Sure Where to Start?

Whether you are facing an urgent question or just want to explore how we can help, I am happy to chat – no sales pitch, no pressure – just helpful advice.

Our Community Bank Solutions

Our network of experts has decades of experience working directly with financial services regulators, including US, European, and Canadian regulators. We know the budget and resource constraints of community banks, so we help them implement right-sized compliance programs that meet regulatory requirements and are sustainable for community banks.

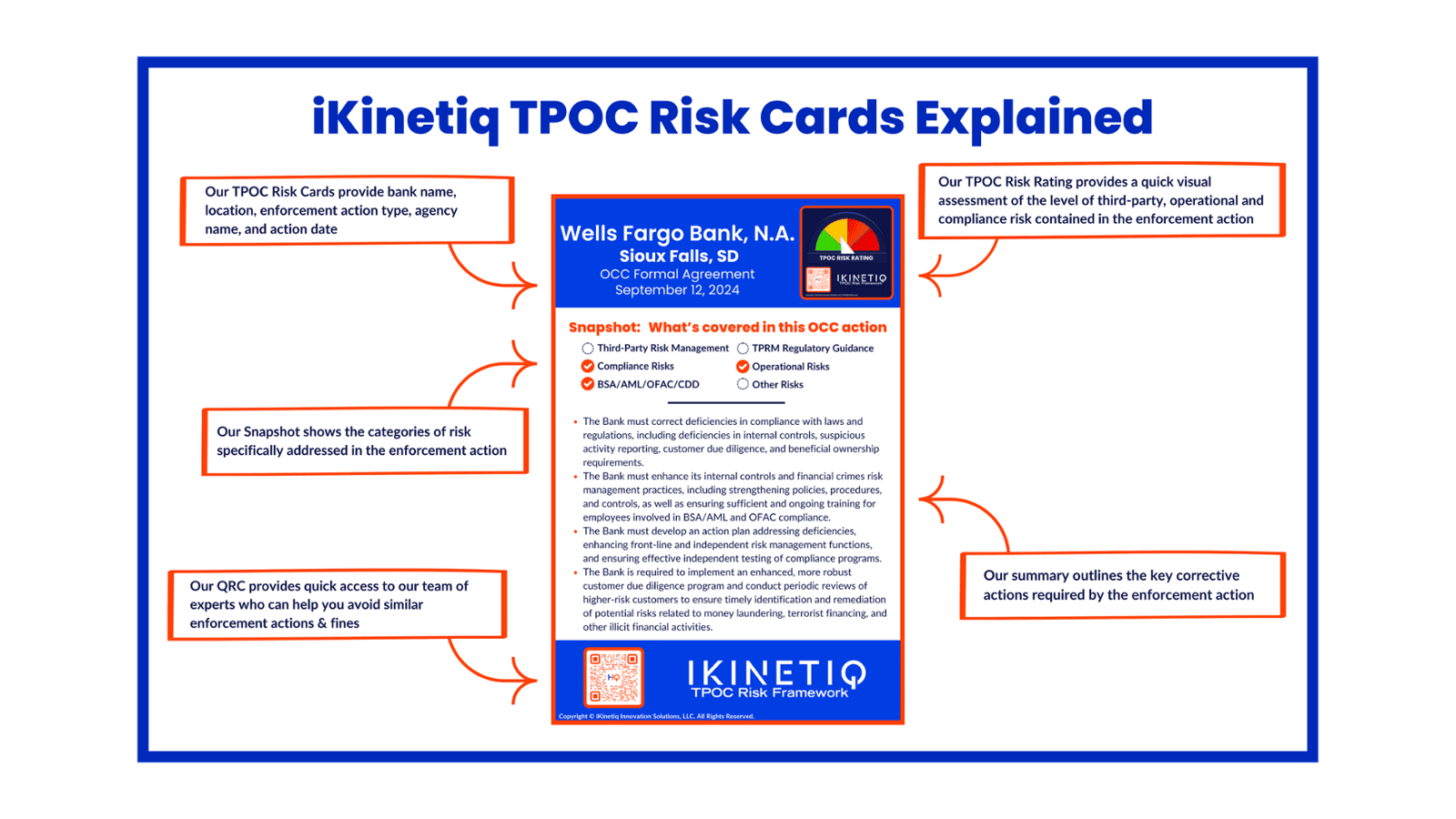

Our TPOC Risk Cards

Our team of experts create a TPOC Risk Card for key regulatory enforcement actions. The Cards provide our clients with a summary of the information needed to understand quickly how the enforcement action impacts their business. The Cards and the array of tools contained in our ТРОС Risk Framework System help our clients avoid similar enforcement actions and fines.

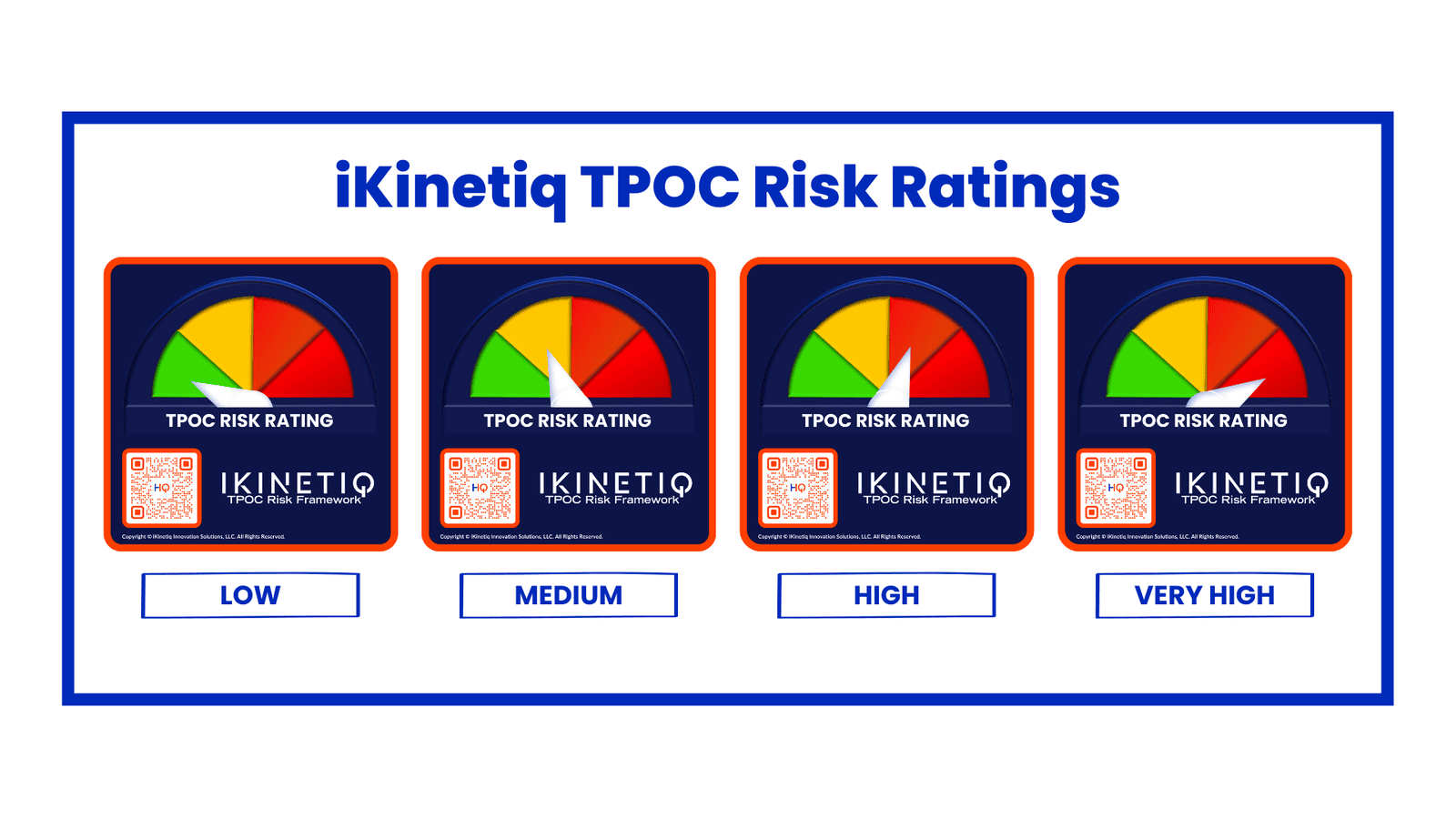

Our TPOC Risk Ratings

iKinetiq's experts are dedicated to helping clients understand the impact of regulatory enforcement actions. We have developed the Third-Party, Operational, and Compliance (TPOC) Risk Framework™ to calculate the ТРОС Risk Rating for each regulatory enforcement action based on our proprietary methodology. There are four risk levels: Low (green); Medium (yellow); High (orange); and, Very High (red).

Ask Our Experts

Have questions for our network of experts? We encourage you to submit your questions. We post our answers to a public FAQ, but we never post any personal details about those submitting the questions. Give us a try today!

2024 Regulatory Enforcement Actions

Office of the Comptroller of the Currency (OCC)

36

Banks

42

Enforcement Actions

$1.29 billion

Total Fines

Federal Reserve Board (Fed)

28

Banks

32

Enforcement Actions

$371 million

Total Fines

Federal Deposit Insurance Corporation (FDIC)

40

Banks

41

Enforcement Actions

$25 million

Total Fines

We do business differently

Specialized Expertise

Our experience is built on decades both as practitioners and as consultants for some of the largest companies in the world. We know our client needs because we've been in their shoes. This allows us to deliver solutions tailored to meet each client's specific needs.

Personalized Service

With a focused client portfolio, we can provide bespoke services and dedicate more senior-level attention to each client project.

Agility

Our size and sector focus allows us to quickly adapt to changing market conditions and client needs, enabling more innovative and tailored solutions.

Strategic Partnerships

We build strong, personal relationships with our clients, allowing us to form long-term strategic partnerships. We succeed when our clients succeed.

Competitive Pricing

Without the overhead costs of larger firms, we can provide world class expertise and specialized services at a more competitive rate, resulting in significant savings for our clients.

Innovative Solutions

Our culture of innovation means we are constantly evaluating and testing cutting-edge technologies. This allows us to deliver accelerated innovation for our clients providing them a competitive advantage.